International financial institutions, development agencies and climate funds have provided financing to water and HPP sector in the Eurasian region in the amount of $11 bln over the past 15 years

In 2022, the EFSD launched its own unique database of sovereign financing in Eurasia. SFD is a unique analytical product that aggregates data on publicly available sovereign financing activities in the Eurasian region. The EFSD is issuing this Working paper in order to present the analysis of sovereign financing in water and HPP sector.

Moscow, October 17, 2023. The EFSD continues the series of working papers with an analysis of sovereign financing in the Eurasian region. The purpose of this Working Paper is to to analyse operations of IFIs, climate funds, and development agencies in the water and HPP sector between 2008 and H1 2023 in 11 countries of the Eurasian region.

The role of IFIs in financing the water and HPP sector is to provide (i) long-term concessional loans; (ii) grant support; (iii) expert support for projects and build the capacity of the recipient state; (iv) TA in project management

The financing of the water and HPP sector in the region is significant and comparable to the total financing of such sectors as education, health, and social protection (about US $11 billion), and is second only to the financing of the transport sector (~US $17 billion). We recommend treating this figure as a rough conservative estimate due to the lack of public information.

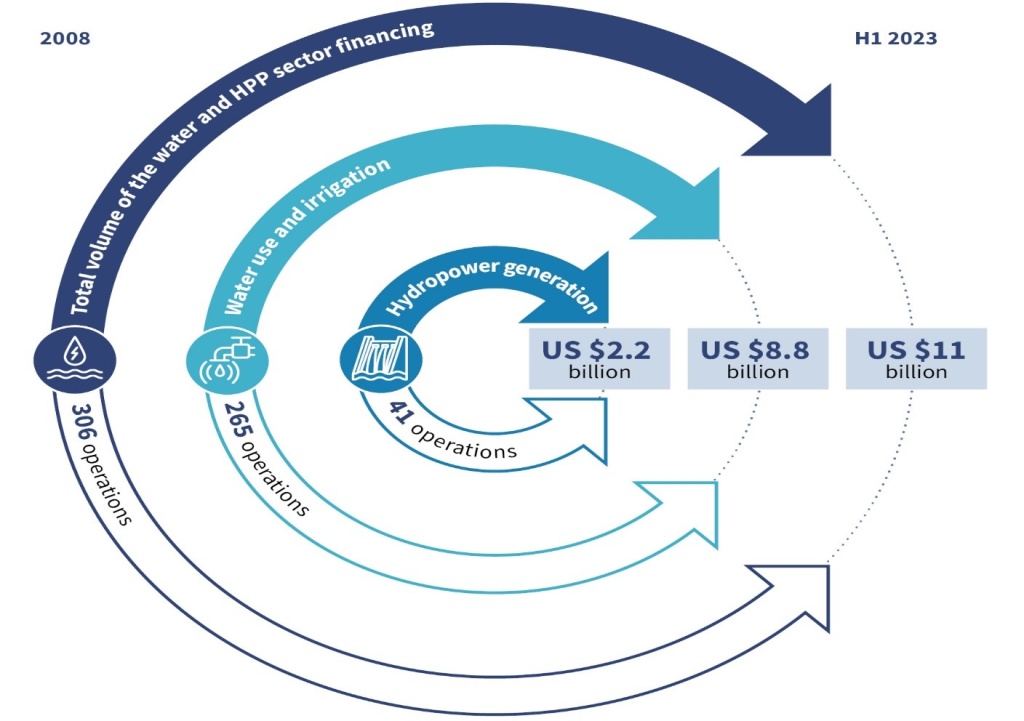

The Sovereign Financing Database contains information on 306 sovereign financing operations in the water and HPP sector worth about US $11 billion. Of these, water use and irrigation account for US $8.8 billion (265 operations), and hydropower generation — for US $2.2 billion (41 operations).

The financing of the water and HPP sector is provided as a package (a mix of loans, grants, and technical assistance throughout the project). Co-financing is actively used by IFIs to support highly capital-intensive water and HPP sector projects (US $2.5 billion, or 22% of total financing). An example of successful co-financing by EFSD, WB and AIIB is the Nurek Hydropower Plant Rehabilitation in Tajikistan.

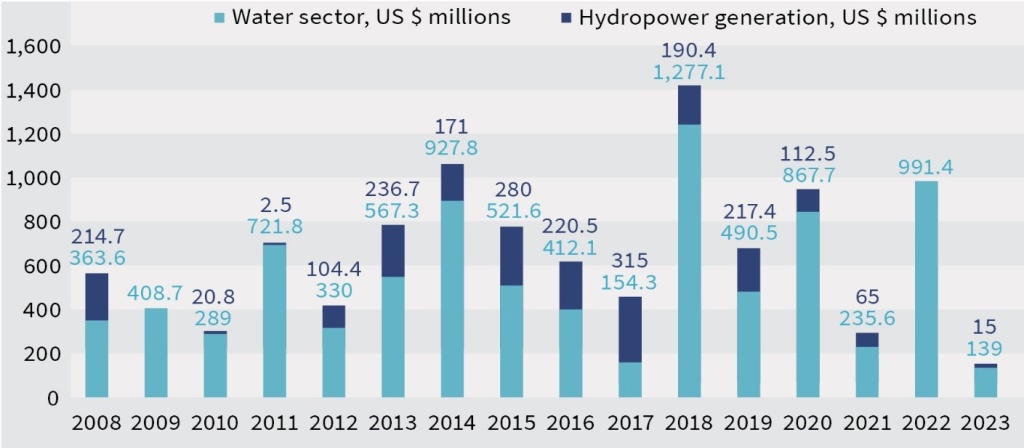

More than half of all water and HPP sector projects worth US $7.8 billion are currently in active phase (162 out of 306). Majority of the projects have an implementation period from 5 to 10 years. Approved financing peaked in 2018.

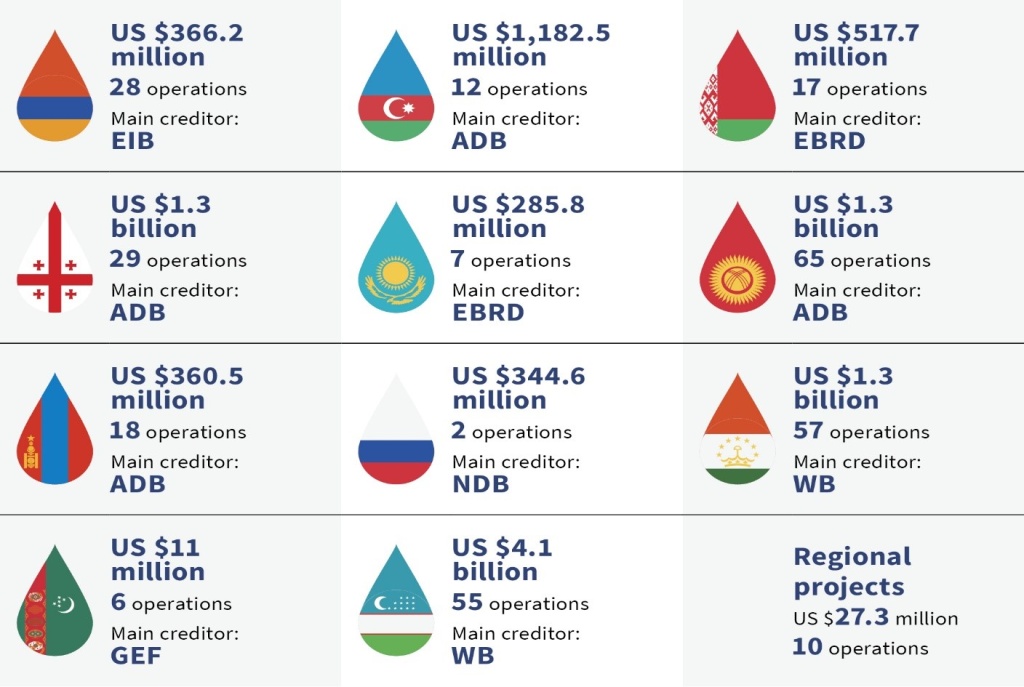

Uzbekistan is the leader in mobilising IFI resources in the water and HPP sector in Eurasia. The amount of approved financing for the period from 2008 to H1 2023 under 55 projects was US $4.1 billion.

The leading positions among the IFIs in terms of approved financing in the water and HPP sector are held by ADB with approved financing of US $3.5 billion and the WB with US $2.8 billion. It is worth mentioning that in terms of hydropower financing, the EFSD is one of the leaders, along with the ADB and the WB.

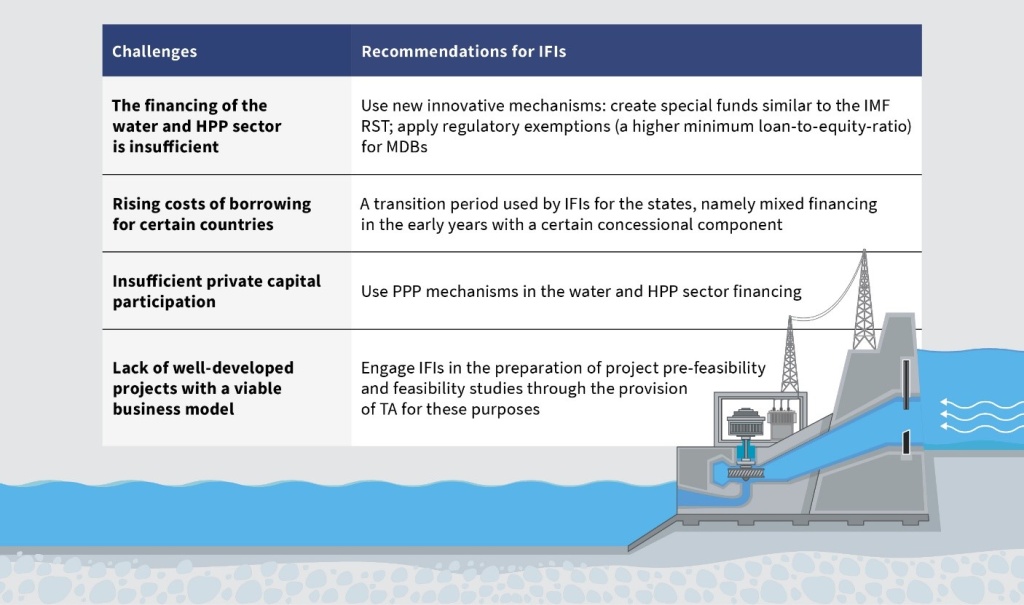

The current financing of the water and HPP sector is insufficient to cover the growing shortage of investments in water infrastructure. Based on an analysis of international experience in financing the water and HPP sector, we have identified key challenges facing the sector and propose several recommendations for IFIs to address them.

The full text of the working paper is available online.

To access the Fund’s publications, please use this link.

Additional Information:

The Eurasian Fund for Stabilization and Development (EFSD) was formed on 9 June 2009 by the governments of the same six countries. The EFSD assists its member states in overcoming the consequences of the global financial crisis, ensuring their economic and financial stability, and fostering integration in the regon.

The EFSD Media Centre:

-

EFSD_MFO_Water_EN_2023-10-09.pdf

PDF, 2.48 Mb

Источник: